All Categories

Featured

Table of Contents

That commonly makes them a more budget-friendly choice for life insurance protection. Lots of people get life insurance policy coverage to help monetarily protect their enjoyed ones in instance of their unexpected fatality.

Or you might have the choice to transform your existing term coverage right into an irreversible plan that lasts the remainder of your life. Different life insurance policy plans have prospective advantages and drawbacks, so it is necessary to comprehend each before you determine to purchase a policy. There are a number of advantages of term life insurance policy, making it a preferred selection for protection.

As long as you pay the premium, your recipients will certainly get the survivor benefit if you pass away while covered. That claimed, it is very important to keep in mind that the majority of policies are contestable for 2 years which indicates insurance coverage can be retracted on fatality, ought to a misrepresentation be located in the application. Policies that are not contestable often have a rated fatality advantage.

What is Level Benefit Term Life Insurance? Key Information for Policyholders

Costs are normally lower than entire life policies. You're not locked into an agreement for the remainder of your life.

And you can not pay out your plan throughout its term, so you won't obtain any kind of financial gain from your previous insurance coverage. Similar to other kinds of life insurance coverage, the expense of a degree term plan depends on your age, coverage requirements, work, lifestyle and wellness. Typically, you'll locate extra affordable insurance coverage if you're younger, healthier and much less risky to insure.

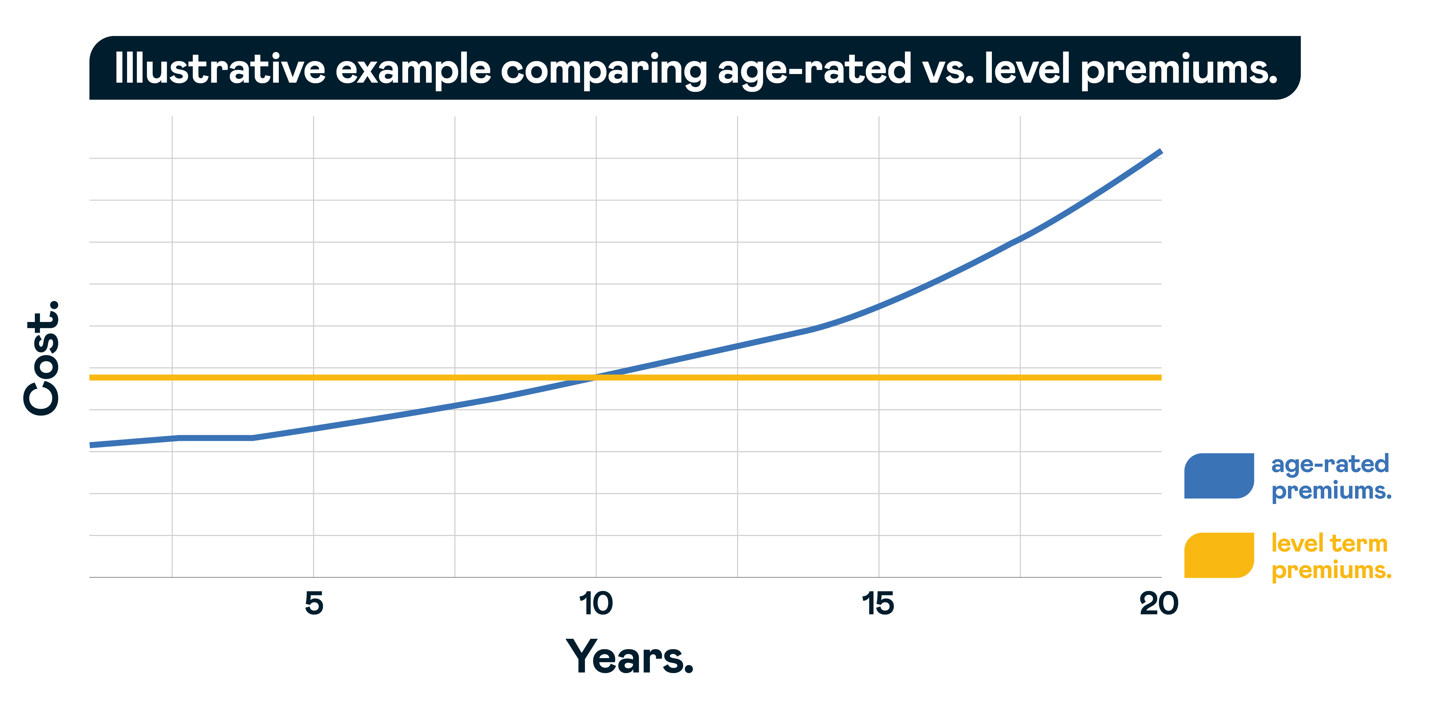

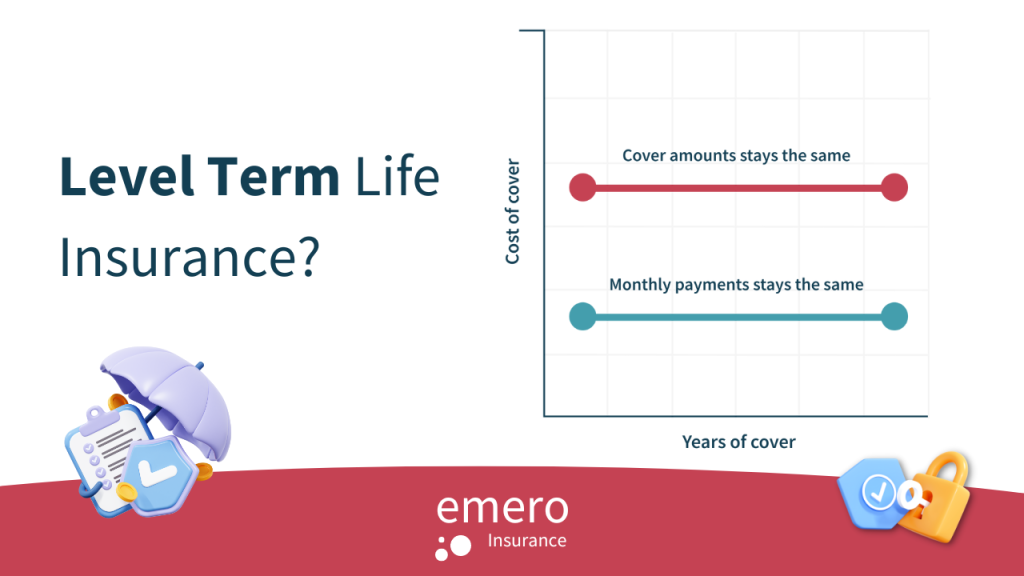

Considering that degree term costs stay the very same for the duration of coverage, you'll know specifically just how much you'll pay each time. That can be a large aid when budgeting your expenses. Level term protection additionally has some versatility, permitting you to personalize your policy with additional functions. These usually been available in the form of riders.

How Does Level Premium Term Life Insurance Policy Work?

You might have to meet particular conditions and certifications for your insurer to pass this motorcyclist. On top of that, there may be a waiting duration of approximately six months prior to working. There also can be an age or time limit on the coverage. You can add a kid biker to your life insurance policy policy so it also covers your youngsters.

The survivor benefit is normally smaller, and coverage normally lasts till your youngster turns 18 or 25. This cyclist may be an extra cost-effective means to help guarantee your youngsters are covered as bikers can typically cover numerous dependents at when. Once your kid ages out of this protection, it might be possible to transform the motorcyclist right into a brand-new policy.

The most usual type of long-term life insurance coverage is entire life insurance coverage, but it has some vital distinctions compared to level term coverage. Here's a basic review of what to consider when contrasting term vs.

What is Level Term Life Insurance Meaning? Learn the Basics?

Whole life insurance lasts insurance coverage life, while term coverage lasts for a specific periodCertain The premiums for term life insurance policy are normally lower than whole life coverage.

One of the highlights of level term insurance coverage is that your costs and your survivor benefit do not transform. With reducing term life insurance coverage, your premiums stay the very same; nonetheless, the survivor benefit amount obtains smaller in time. You might have insurance coverage that begins with a fatality advantage of $10,000, which can cover a home loan, and after that each year, the fatality advantage will certainly decrease by a set quantity or portion.

Due to this, it's typically a much more budget friendly kind of degree term coverage., however it may not be enough life insurance for your demands.

Key Features of Term Life Insurance For Couples Explained

After selecting a plan, complete the application. For the underwriting process, you may need to supply basic individual, health and wellness, way of living and work info. Your insurance firm will certainly identify if you are insurable and the threat you might present to them, which is shown in your premium prices. If you're approved, sign the documents and pay your first costs.

You might desire to upgrade your beneficiary information if you have actually had any type of significant life changes, such as a marital relationship, birth or divorce. Life insurance can often really feel complex.

No, level term life insurance policy does not have cash money value. Some life insurance policies have an investment function that permits you to construct money value gradually. A portion of your costs payments is reserved and can earn interest over time, which grows tax-deferred throughout the life of your coverage.

You have some choices if you still desire some life insurance policy protection. You can: If you're 65 and your protection has run out, for instance, you may desire to buy a new 10-year level term life insurance coverage policy.

What is the Advantage of Level Term Vs Decreasing Term Life Insurance?

You might have the ability to convert your term insurance coverage right into a whole life plan that will certainly last for the remainder of your life. Several sorts of degree term policies are convertible. That means, at the end of your protection, you can transform some or every one of your policy to whole life insurance coverage.

A degree costs term life insurance plan lets you stick to your budget while you aid protect your household. Unlike some tipped price plans that enhances yearly with your age, this kind of term strategy supplies rates that stay the same through you pick, even as you grow older or your wellness modifications.

Discover more concerning the Life Insurance coverage choices readily available to you as an AICPA participant (Guaranteed level term life insurance). ___ Aon Insurance Providers is the brand name for the broker agent and program administration operations of Affinity Insurance Services, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Firm, Inc. (CA 0795465); in Okay, AIS Affinity Insurance Coverage Providers Inc.; in CA, Aon Affinity Insurance Policy Solutions, Inc .

Latest Posts

Life Insurance To Cover Funeral Expenses

Difference Between Life Insurance And Final Expense

Cost Of Funeral Insurance